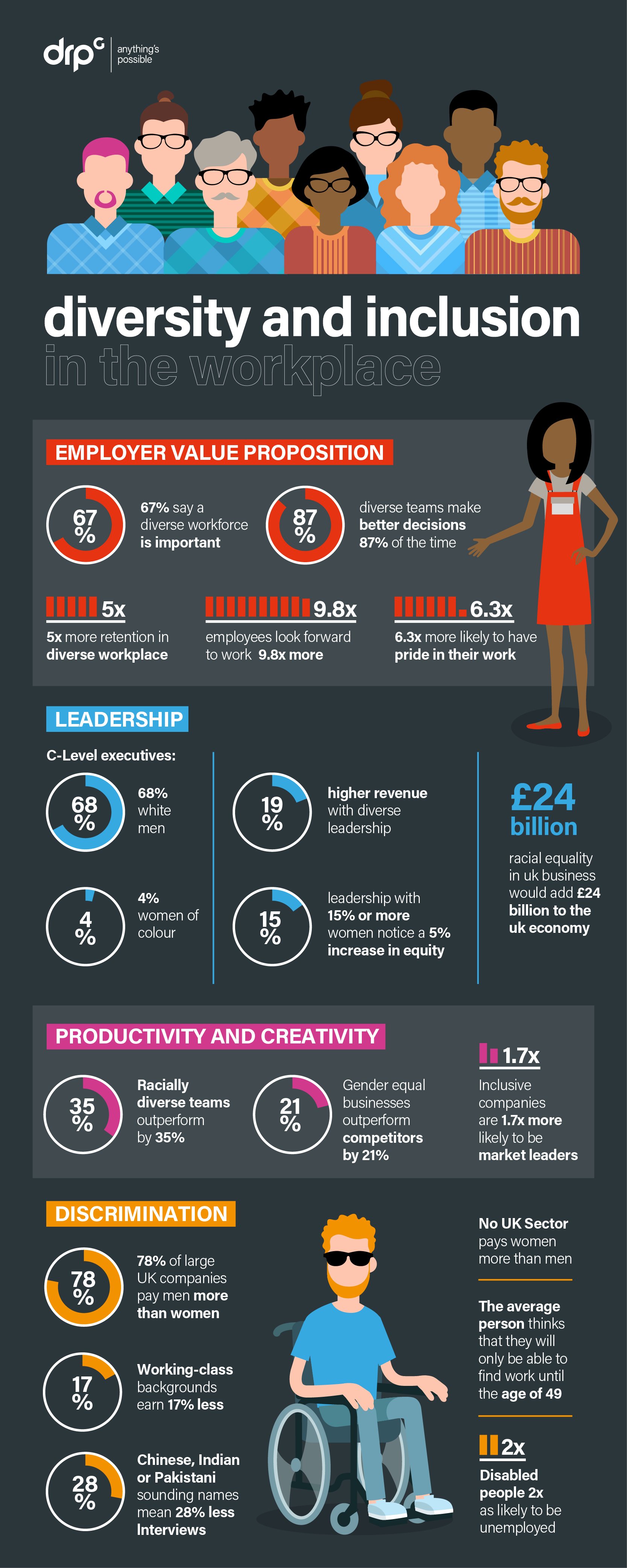

The accounting profession has long been synonymous with numbers, spreadsheets, and meticulous record-keeping. However, the advent of technology is reshaping this landscape in ways that were unimaginable just a few decades ago. From automation to artificial intelligence, the integration of these tools is not only enhancing efficiency but also redefining the role of accountants. This article explores how technology is transforming the accounting profession, the benefits and challenges it presents, and what the future might hold.

The Rise of Accounting Automation

One of the most significant technological advancements in accounting is automation. Tasks that once required hours of manual input can now be completed in minutes or even seconds. Automation software streamlines the accounting process by handling repetitive tasks, such as data entry and report generation.

- Time Savings: Automation can save up to 40% of the time spent on routine accounting tasks.

- Reduction of Errors: Automated systems have a lower error rate compared to human input, leading to more accurate financial records.

- Increased Productivity: Accountants can focus more on strategic decision-making rather than mundane tasks.

For example, platforms like QuickBooks and Xero have integrated automation capabilities that allow businesses to automate invoicing, payroll, and expense tracking. According to a report by Accenture, organizations that have adopted automation technologies have seen a productivity increase of up to 30%.

The Impact of Cloud Computing

Cloud computing has revolutionized how accounting firms operate. By migrating to cloud-based systems, accountants can access financial data from anywhere, at any time, enabling greater flexibility and collaboration.

- Real-Time Data Access: Cloud accounting allows for real-time updates, which is crucial for timely decision-making.

- Cost Efficiency: Cloud solutions often reduce the need for expensive on-premise hardware and IT support.

- Enhanced Collaboration: Multiple users can access and work on the same data simultaneously, improving teamwork.

A case study of a mid-sized accounting firm, Smith & Co., illustrates this point. After transitioning to a cloud-based accounting platform, they reported a 20% increase in client satisfaction due to faster response times and improved accuracy in reporting.

Artificial Intelligence and Machine Learning in Accounting

Artificial intelligence (AI) and machine learning (ML) are at the forefront of technological advancements in accounting. These technologies can analyze vast amounts of data to provide insights and predict trends, allowing accountants to make more informed decisions.

- Predictive Analytics: AI can forecast financial trends based on historical data, helping businesses plan for the future.

- Fraud Detection: Machine learning algorithms can identify anomalies in financial transactions that may indicate fraudulent activity.

- Enhanced Decision-Making: AI tools can provide actionable insights, allowing accountants to offer more strategic advice to clients.

For instance, Deloitte has implemented AI-driven analytics in its audit process, which has significantly reduced the time needed for audits and improved the quality of insights provided to clients.

The Role of Mobile Accounting Apps

With the rise of smartphones and tablets, mobile accounting applications have gained popularity. These apps allow users to manage their finances on-the-go, making accounting more accessible to small business owners and freelancers.

- Convenience: Users can manage invoices, track expenses, and check financial reports anywhere.

- Instant Notifications: Mobile apps can send reminders for bill payments and upcoming deadlines.

- User-Friendly Interfaces: Many mobile accounting apps are designed with non-accountants in mind, making them easy to use.

Wave and FreshBooks are examples of mobile accounting applications that have garnered a loyal user base due to their ease of use and robust features. A survey by Clutch found that 58% of small business owners use mobile accounting apps to manage their finances.

Blockchain Technology in Accounting

Blockchain technology is another innovation that is making waves in the accounting profession. By providing a decentralized ledger for transactions, blockchain enhances transparency and security in financial reporting.

- Increased Transparency: All transactions recorded on a blockchain are visible to authorized users, reducing the risk of fraud.

- Enhanced Security: The decentralized nature of blockchain makes it difficult for unauthorized parties to alter transaction records.

- Efficiency in Auditing: Auditors can access real-time transaction data, streamlining the audit process.

A notable example is the collaboration between major accounting firms like PwC and blockchain technology companies to develop solutions that improve auditing and financial reporting processes. PwC has experimented with blockchain to track assets and verify ownership, demonstrating the technology’s potential to revolutionize traditional accounting practices.

Challenges of Technology Adoption in Accounting

Despite the numerous benefits, the adoption of technology in accounting is not without challenges. Some of the key hurdles include:

- Data Security Concerns: As financial data moves online, the risk of cyberattacks increases, necessitating robust security measures.

- Skill Gaps: Accountants must adapt to new technologies, which may require additional training and education.

- Resistance to Change: Some professionals may be hesitant to adopt new technologies, preferring traditional methods.

According to a survey by the American Institute of CPAs (AICPA), 50% of accountants reported that they feel unprepared to adapt to new technologies, highlighting the need for ongoing education and training in the profession.

The Future of Accounting in a Technological World

The future of accounting is undoubtedly intertwined with technology. As innovations continue to emerge, the profession will likely evolve in several ways:

- Increased Focus on Advisory Services: Accountants will spend more time providing strategic advice rather than just handling compliance and reporting.

- Integration of Advanced Technologies: The use of AI, ML, and blockchain will become commonplace in accounting practices.

- Emphasis on Continuous Learning: Ongoing education will be essential for accountants to stay relevant in a rapidly changing landscape.

In conclusion, technology is transforming the accounting profession in profound ways, driving efficiency, accuracy, and strategic decision-making. While challenges exist, the benefits of embracing these technologies far outweigh the drawbacks. As accountants adapt to new tools and methodologies, they will not only enhance their own practices but will also provide greater value to their clients. The future of accounting is bright, and those who embrace technological advancements will be well-positioned to lead the profession into the next era.